- Call Us Today! 888-308-3400

At Starbanco Business Finance, we confidently ensure the success of our clients. Our recent transactions exhibit our unwavering commitment to meeting our clients varying financing needs. Our team of lending experts are well-versed in handling loan requests of all types. We offer an array of financial services with tailored solutions to meet each of our client’s unique demands.

Erie, PA

A multi-family investor needed to pay off a maturing mortgage. Due to the tertiary market the property is located in, prime financing was unavailable. Starbanco was able to provide interim bridge financing while the borrower readies the property for agency financing.

Program: Bridge Loan

Purpose: Mortgage Payoff

Amount: $1,570,000

Bronx, NY

A local real estate investor had the opportunity to acquire a twenty unit apartment building in Bronx, NY. The borrower’s local bank was unable to offer financing due to portfolio restrictions. Starbanco was able to structure a commercial real estate loan that provided funds for the acquisition and minor renovations.

Program: CRE Loan

Purpose: Commercial Real Estate Acquisition / Renovations

Amount: $8,100,000

Austin, TX

A local brewery wanted to expand its production facility by acquiring a neighboring warehouse that was being sold by an estate. Traditional bank financing was not an option due to the requirement to close within thirty days. Starbanco was able to meet the borrower’s needs and timeline with a bridge financing loan.

Program: Bridge Loan

Purpose: Acquisition

Amount: $3,600,000

Madison, WI

A large trucking company needed to retire a maturing mortgage on their main terminal. Due to property type the borrowers’ local bank was not able to offer financing. Starbanco was able to meet the borrowers’ needs with a commercial real estate loan that provided funds for consolidation and working capital.

Program: CRE Loan

Purpose: Consolidation / Working Capital

Amount: $12,000,000

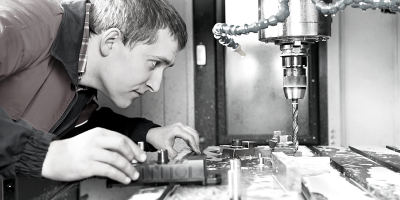

Grand Rapids, MI

A local sheet metal fabrication company was in work-out with their bank due to a decline in sales in recent years. Starbanco was able to meet the borrower’s needs by structuring funding for consolidation and working capital with an I/O bridge loan.

Program: Bridge Loan

Purpose: Consolidation / Working Capital

Amount: $2,350,000

Chicago, IL

A local restaurant chain needed to payoff several high cost cash advances and obtain funds for working capital. Due to the loan amount their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a two year I/O bridge loan.

Program: Bridge Loan

Purpose: Debt Consolidation / Working Capital

Amount: $2,900,000

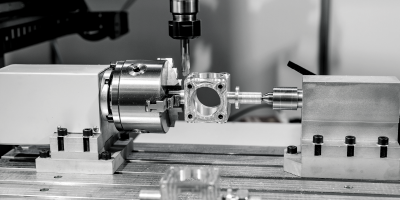

Kansas City, MO

A large CNC machining company needed to pay off a tax lien, consolidate business debt, and obtain funds for working capital. Due to the tax lien, their local bank was unable to approve the request. Starbanco was able to meet the borrower’s needs with a two-year I/O bridge loan.

Program: Bridge Loan

Purpose: Tax Lien Payoff / Debt Consolidation / Working Capital

Amount: $4,750,000

Fort Lauderdale, FL

A local commercial bakery needed to refinance a maturing mortgage; Due to a tax lien their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a bridge loan.

Program: Bridge Loan

Purpose: Tax Lien Payoff / Mortgage Refinance

Amount: $4,875,000

Spencer, NC

A large mobile home park needed to refinance a matured bridge loan and payoff outstanding taxes. Due to property type and necessary timeline to close, their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a conventional term loan.

Program: Conventional Term Loan

Purpose: Mortgage Refinance / Tax Payoff

Amount: $1,460,000

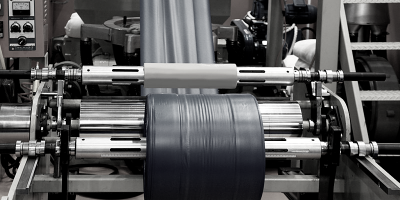

Miami, FL

A large plastic resin manufacturer needed to obtain funding for expansion. Their local bank was unable to approve the request as they already reached the debt ceiling. The local bank referred the borrower to Starbanco to provide a funding solution. The borrower received the funding they needed, and the local bank retained their customer.

Program: Conventional Term Loan

Purpose: Mortgage Refinance / Working Capital

Amount: $8,000,000

Boston, MA

A local CNC machining company needed funding to refinance a matured mortgage. Due to weak prior year sales the current lender was not able to approve the request. Starbanco was able to meet the borrowers needs with a conventional term loan.

Program: Conventional Term Loan

Purpose: Mortgage Refinance / Working Capital

Amount: $3,850,000

Austin, TX

A local trucking company was placed into work-out by its current lender due to a covenant violation. Because of declining sales, the borrower was not able to source funding. Starbanco was able to meet the borrowers need with a bridge loan.

Program: Bridge Loan

Purpose: Debt Consolidation / Working Capital

Amount: $3,000,000

Boulder, CO

A local brewery needed funding for warehouse expansion. Due to industry type their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a bridge loan.

Program: Bridge Loan

Purpose: Expansion / Inventory

Amount: $2,800,000

Virginia Beach, VA

A large lawn and garden retailer needed to payoff a substantial tax lien, consolidate debt, and obtain funds for inventory. Due to the tax lien their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a term loan.

Program: Term Loan

Purpose: Tax Lien Payoff / Debt Consolidation / Inventory

Amount: $1,475,000

Tempe, AZ

A local commercial plumbing contractor needed funding to purchase flex space within an industrial warehouse development. The borrowers local bank could not provide the capital needed due to the type of property being acquired. Starbanco was able to meet the borrowers needs with a CRE loan.

Program: CRE Perm Loan

Purpose: Commercial Real Estate Acquisition

Amount: $1,900,000

Denver, CO

A local franchise of a national staffing chain needed funding for the acquisition of a commercial office condo. The borrowers local bank was unable to offer financing due to prior credit issues. Starbanco was able to meet the borrowers needs by providing funds for the acquisition.

Program: CRE Term Loan

Purpose: Commercial Real Estate Acquisition

Amount: $1,250,000

Colorado Springs, CO

A franchise of a national automotive service chain was given the opportunity to acquire several corporate owned units within his local market. Traditional bank sources could not respond fast enough, but Starbanco was able to structure the capital the borrower needed within thirty days of application.

Program: Term Loan

Purpose: Acquisition and Expansion

Amount: $2,900,000

Tacoma, WA

A local franchise of a national convenience store chain was given the opportunity to purchase several corporate owned units within their territory. Bank financing was not an option due to the amount of down payment they wanted from the borrower. Starbanco was able to structure 100% financing for the acquisition and expansion of this national brand.

Program: Term Loan

Purpose: Acquisition and Expansion

Amount: $3,750,000

Birmingham, AL

A large metal fabrication facility needed immediate funding to acquire one of its competitors through a forced asset sale. Typical bank financing was not an option due to time constraints of the sale. Starbanco structured a term loan allowing for the acquisition to take place in just two weeks from date of application.

Program: Term Loan

Purpose: Expansion and Asset Purchase

Amount: $2,800,000

St. Louis, MO

A large independent grocery retailer wanted to renovate its current facility and expand storage space to accommodate additional inventory. The borrowers current bank was not able to assist due to the request being above the individual borrower limit. Starbanco was able to structure a term loan allowing for the renovations and expansion in under thirty days.

Program: CRE Bridge Loan

Purpose: Renovations and Expansion

Amount: $5,300,000

Cleveland, OH

A large marine shipping company wanted to expand its Lake Erie operation by acquiring an existing freight business. Bank financing was not an option as the terms of the sale called for a closing within thirty days. Starbanco was able to structure a term loan allowing for the acquisition of the business and working capital, all in under two weeks!

Program: Term Loan

Purpose: Acquisition and Working Capital

Amount: $3,750,000

Plano, TX

A local boutique hotel owner wanted to convert his location into a flagged franchise hotel. To do so, the franchisor required extensive renovations and upgrades. Due to industry type, the borrower’s current bank was not able to offer funding. Starbanco was able to structure a bridge loan allowing for the conversion, renovations and upgrades.

Program: CRE Bridge Loan

Purpose: Franchise Conversion, Renovations, Upgrades

Amount: $4,700,000

Miami, FL

A large marina wanted to renovate its current facility and expand dock space to accommodate an additional fifty boats. The borrowers current bank was not able to assist due to the property type. Starbanco was able to structure a term loan allowing for the renovations and expansion, in under thirty days.

Program: Term Loan

Purpose: Renovations and Expansion

Amount: $2,200,000

Westminster, CO

A local independent hotel owner wanted to convert his location into a flagged franchise hotel. To do so, the franchisor required extensive renovations and upgrades. Due to historical cash-flow issues the borrowers current bank would not offer funding. Starbanco was able to structure a projection-based bridge loan allowing for the conversion, renovations and upgrades.

Program: Bridge Loan

Purpose: Franchise Conversion, Renovations, Upgrades

Amount: $4,700,000

Columbus, OH

A local trucking company needed immediate funding to payoff a matured mortgage held by a local Bank. Faced with the real possibility of foreclosure, traditional lenders did not have any interest in working with this borrower. Starbanco was able to structure a bridge loan allowing for the payoff of the mortgage and consolidation of all the borrowers additional debts.

Program: Bridge Loan

Purpose: Debt Consolidation

Amount: $3,750,000

Minneapolis, MN

A local franchisee of a large national restaurant and bar concept needed funding for renovations, consolidation of debt and working capital. Starbanco was able to structure a small business term loan that allowed the borrower to reach their funding goals.

Program: Term Loan

Purpose: Renovations

Amount: $550,000

San Antonio, TX

A local franchisee of a large national insurance and investment company needed to obtain funding to acquire an additional territory. Starbanco was able to structure a small business term loan allowing for the acquisition to be completed. In addition, the borrower obtained working capital to fuel continued growth.

Program: Term Loan

Purpose: Acquisition

Amount: $4,650,000

Bethesda, MD

A local high end spa planning to re-locate into a new larger space offering higher visibility and increased foot traffic needed funding for renovations, FF&E and inventory. Starbanco was able to structure a small business term loan allowing them to complete the renovations, acquire the FF&E and inventory along with a global consolidation of all outstanding debts.

Program: Term Loan

Purpose: Expansion

Amount: $950,000

Spokane, WA

A local real estate developer wanted to purchase and renovate a large office building. With only thirty days to close, bank financing was not an option. Starbanco was able to structure a bridge loan allowing for the acquisition and renovations to be completed. The loan was closed in just 24 days, something traditional bank financing could have never been able to do.

Program: CRE Bridge Loan

Purpose: Real Estate Acquisition and Renovation

Amount: $9,600,000

Chicago, IL

An independent distributor of disposable medical supplies needed funding for inventory and warehouse expansion. Bank financing was not available due to the owners low credit score and lack of collateral. Starbanco was able to structure a term loan allowing the borrower to obtain the inventory and complete the expansion to its current warehouse.

Program: Term Loan

Purpose: Inventory and Expansion

Amount: $4,900,000

Kansas City, MO

A local veterinary hospital wanted to expand by adding additional square footage to its current facility. Their credit union did not offer commercial real estate financing so they referred the borrower to Starbanco. A capital solution was provided to the borrower for the renovation and the credit union was able to keep the deposit relationship intact.

Program: CRE Loan

Purpose: Expansion

Amount: $2,200,000

Jacksonville, FL

A local franchisee of a national full service restaurant concept needed immediate capital to complete mandatory upgrades to it’s current location. Traditional Bank financing was not an option due to the extended time needed to close. Starbanco was able to structure a twenty four month I/O Bridge loan that allowed for the needed upgrades, all within thirty days.

Program: CRE Bridge Loan

Purpose: Upgrades and FF&E

Amount: $1,100,000

Nashville, TN

A local electrical supply company needed funding to expand it’s current location to include a new showroom and design area. Due to a prior bankruptcy, Bank financing was not a viable option. Starbanco was able to structure a twenty four month I/O Bridge loan allowing for the expansion to be completed.

Program: CRE Bridge Loan

Purpose: Expansion

Amount: $1,750,000

Norfolk, VA

A national manufacturer of specialized valve components was forced into a workout situation by its current Bank due to a covenant violation. Due to a significant cash-flow shortage traditional Bank financing was not an option. Starbanco was able to structure a thirty six month I/O Bridge loan in tandem with a borrowing base secured by A/R, Inventory and Machinery.

Program: CRE Bridge Loan – A/R Line

Purpose: Turnaround

Amount: $7,250,000

Ft. Lauderdale, FL

A large meat processing plant in South Florida was in work-out with it’s mortgage lender due to a covenant violation. The lender was pressing the borrower to payoff the debt or face foreclosure. Starbanco structured a thirty six month I/O bridge loan allowing the company to payoff the current lender and improve cash flow.

Program: Bridge Loan

Purpose: Refinance Current Mortgage

Amount: $4,500,000

Nashville, TN

An experienced hotel operator was given the opportunity to purchase a historic Nashville hotel that had fallen into bankruptcy. In order to obtain the property they had to close in under a month, traditional Bank sources were not an option. Starbanco was able to respond with a twenty four month bridge loan allowing for the acquisition of the property and funding for franchise conversion improvements.

Program: Bridge Loan

Purpose: Hotel Acquisition

Amount: $4,650,000

Orlando, FL

A franchisee of a national burger chain was given the opportunity to acquire several corporate owned units within his local market. Traditional Bank sources could not respond fast enough, Starbanco was able to structure the capital the borrower needed within thirty days of application.

Program: SBA 7(a)

Purpose: Franchise Expansion

Amount: $3,750,000

Baltimore, MD

A local franchisee of a frozen dessert concept needed funding for the acquisition of a commercial property. The borrowers local bank was unable to offer financing. Starbanco was able to meet the borrowers needs with a SBA 7(a) loan that provided funds for the acquisition, renovations, FF&E and working capital.

Program: SBA 7(a)

Purpose: Commercial Real Estate Acquisition

Amount: $2,500,000

Detroit, MI

A national supplier of goods to big box retailers, convenience and hardware stores needed to improve cash-flow allowing for continued growth. The borrowers local bank could not provide the capital they needed to fuel continued growth. Starbanco was able to meet the borrowers needs with $1,500,000 A/R line.

Program: A/R Line

Purpose: Working Capital/Inventory

Amount: $1,500,000

Ocean View, NJ

A large heating and air conditioning company needed to payoff a substantial tax lien, consolidate additional debt and obtain funds for working capital. Due to the tax lien their local bank was unable to approve the request. Starbanco was able to meet the borrowers needs with a three year I/O bridge loan.

Program: Bridge Loan

Purpose: Tax Lien Payoff/Debt Consolidation

Amount: $3,000,000

Could you be our next success story?

©2024 Starbanco Business Finance. All rights reserved. Some programs and terms may not be available in all states, information subject to change without notice, see us for more details.